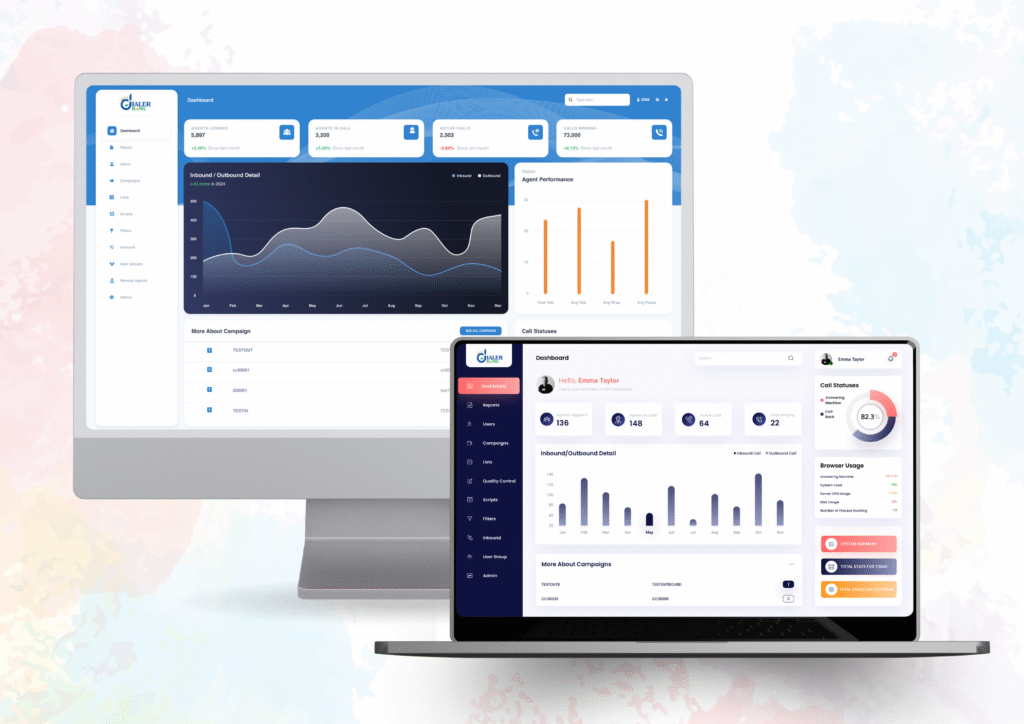

Vicidial Development for Insurance Agents: Automate Calls & Improve Policy Management

It often leads to a chaotic mess, lost sales, and unhappy clients. This is where Vicidial Development comes in as a game-changer. We’ll also highlight how Custom Vicidial Solutions improve policy management, enhance customer engagement, and support compliance—all while boosting sales and customer trust.

Why Insurance Agents Need Automation in 2025

The pressure on insurance agents has never been higher. Their customers expect smooth interactions, speedy claim resolutions, and helpful nudges about policy renewals. With the industry becoming more and more competitive, agents who stick to manual, hands-on processes are getting left behind.

Here are some common pain points agents face without automation:

Missed follow-ups on insurance leads.

High customer churn due to poor engagement.

Inefficient manual dialing, wasting hours each day.

Difficulty tracking renewals and policy updates.

Compliance risks when managing sensitive customer data.

By adopting Vicidial Development, insurance companies can implement:

Automated calling systems with predictive dialers.

CRM integration for unified policy management.

Don’t Miss:Solar Lead Generation Solutions

What is VICIdial and Why Insurance Agents Should Care? VICIdial is one of the world’s most popular open-source call center software solutions, trusted by thousands of businesses globally. Its flexibility and scalability make it ideal for insurance agents and companies who need to manage high call volumes while maintaining personalized customer service. For insurance businesses, VICIdial is not just software—it’s a productivity engine that turns policy management and lead generation into seamless, automated workflows. Benefits of VICIdial Development for Insurance Agents When tailored for the insurance sector, Vicidial Development offers industry-specific benefits. 1. Automating Outbound Calls & Follow-Ups Predictive dialers and auto dialers allow agents to reach more customers in less time. 2. Simplifying Policy Management With VICIdial’s CRM connection, every call is logged and all renewals and claims are closely followed. 3. Enhancing Lead Conversion & Customer Acquisition Increase your conversion rates with VICIdial. Since closing a deal is all about speed, our automated system connects agents to new leads the very second they respond. 4. Reducing Manual Workload Free up your agents from time-consuming tasks. Stop letting repetitive chores hold your agents back. The result? More sales in less time. How VICIdial Improves Policy Management Policy management is one of the most critical tasks for insurance agents. VICIdial helps agents by: Integrating with insurance CRMs to display policy details during calls. Automating renewal reminders via voice calls, SMS, or email. Tracking claims and follow-ups with workflow automation software. Providing real-time analytics to monitor active policies and renewal success rates. VICIdial Features Tailored for Insurance Call Centers Insurance agents benefit from VICIdial features that go beyond basic calling. Predictive Dialing – Reach more prospects quickly. IVR (Interactive Voice Response) – Let customers check policy details or claim status without speaking to an agent. Real-Time Analytics & Reports – Enables data-driven decisions. Omnichannel Communication – Supports calls, email, SMS, and WhatsApp. Remote-Friendly Cloud Deployment – Agents can work from anywhere. Intelligent Call Routing – Matches customers with the right agent using conversational AI and intent data. CRM Integration with VICIdial for Insurance Agents A major advantage of Vicidial Development is its seamless CRM integration. The unified agent desktop shows complete customer journeys in one place. API integration ensures workflows run smoothly across platforms. With CRM integration, agents don’t just make calls—they manage the entire insurance lifecycle in one system. Compliance & Security in Insurance Communication Insurance businesses handle sensitive customer data, which requires strict compliance. VICIdial supports this through: Call recording and storage encryption. By combining automation with compliance & security, Vicidial Development helps insurance agents maintain trust and regulatory readiness. Future of VICIdial Development in Insurance The future of insurance call centers lies in AI, automation, and omnichannel engagement. With evolving technology, Vicidial Development will continue to grow in areas like: AI-powered conversational intelligence for claim handling. Generative AI for personalized customer scripts. Conversational AI chatbots for policy queries. Hyper-personalization of offers using intent data. Real-time analytics & agent assist tools for optimization. Common Challenges Insurance Agents Face Without VICIdial Manual dialing leads to wasted hours. Missed renewal calls reduce retention. Policy details scattered across systems. Inability to measure agent performance effectively. Low first call resolution (FCR) due to poor workflows. By investing in Vicidial Development, insurance companies eliminate these inefficiencies and move toward operational excellence. Popular Article: Live Demo Of Our Solutions

Case Study: How VICIdial Transformed an Insurance Agency An insurance agency with 50 agents struggled with: 40% missed follow-ups. Slow response times. Low policy renewal rates. After adopting a customized VICIdial call center solution: Lead response time improved by 60%. Policy renewals increased by 30%. Agent productivity rose by 25%. Customer satisfaction scores improved by 35%. This shows how the right Vicidial Development can directly impact growth, efficiency, and customer loyalty. FAQs on VICIdial for Insurance Agents Q1: What is VICIdial and how does it help insurance agents? VICIdial is an open-source call center software that automates outbound and inbound calls, integrates with CRMs, and streamlines policy management for insurance businesses. Q2: Can VICIdial handle both inbound and outbound calling? Need a system that handles both incoming and outgoing calls? VICIdial is your solution for everything from claims management to lead generation and renewals. Q3: Is VICIdial secure for handling sensitive policy data? Absolutely. With data security, encryption, and compliance monitoring, VICIdial ensures safe handling of sensitive insurance data. Q4: What’s the ROI of investing in VICIdial for insurance companies? Insurance companies typically see faster lead conversions, higher retention rates, better compliance, and improved agent performance, leading to a strong ROI. Conclusion Vicidial Development is not just a technology upgrade—it’s a necessity. VICIdial makes it easier for insurance agents to do their jobs by handling outbound calls automatically, simplifying policy management, and connecting to their CRM. With tools like predictive dialing, a mix of communication options, and automated tasks, it helps insurance companies run better, connect more with customers, and earn more money. At DialerKing, we specialize in customized Vicidial Development for insurance agents and call centers. Whether you want to automate insurance calls, improve policy management, or boost lead generation, we deliver scalable, secure, and AI-driven solutions. Ready to transform your insurance business? Contact DialerKing today for the best VICIdial solutions for insurance agents. Note: At Dialerking technology , we specialize in VICIdial installation, white label customization, and seamless software integration tailored to your business needs.

Call Recording – Helps in compliance monitoring and training.

Secure CRM integration with data privacy controls.

Compliance monitoring for insurance regulations.

Email: dialer@dialerking.com

Email: dialer@dialerking.com  Phone: +91 940 820 7777

Phone: +91 940 820 7777  WhatsApp: +1 (202) 249-5906

WhatsApp: +1 (202) 249-5906  Microsoft Teams

: dialerking1@gmail.com

Microsoft Teams

: dialerking1@gmail.com

Find Your Perfect Role

Find Your Perfect Role